What should investors do if the market is sending them conflicting signals?

What should investors do if the market is sending them conflicting signals?

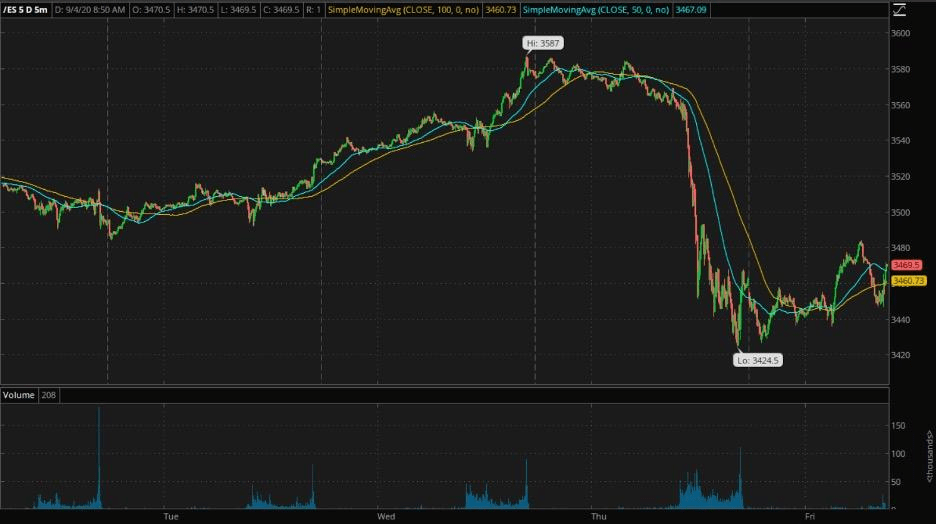

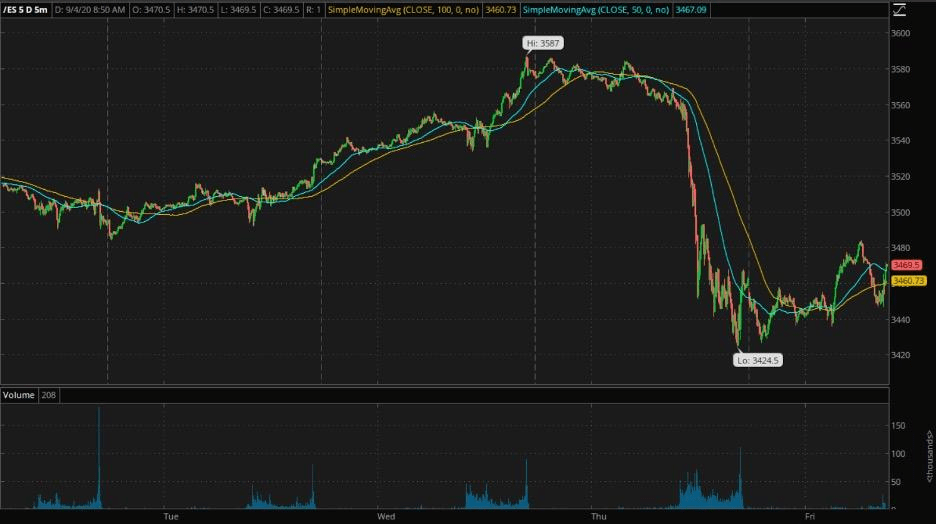

During the morning hours of yesterday, before the flurry of market activity began, I penned an article highlighting the underlying weakness in the weekly unemployment claims number. It was apparent that the market’s initial positive reaction to this seemingly favorable figure was short-lived, as a negative pre-market response hinted at a deeper understanding of the situation. The tone was unmistakably bearish, but even I didn’t anticipate the drastic turn of events that unfolded in the S&P 500 E-Mini futures contract once the main trading session commenced:

What we witnessed was a classic and substantial selloff, akin to what we experienced back on June 11. Reflecting on that prior drop, it turned out to be a significant opportunity for investors. Now, the question is whether this current decline follows a similar path or resembles the ominous trajectory we observed in late February, which ultimately led to a major correction.

Determining the outcome hinges on two critical factors: the catalyst behind yesterday’s selloff and its characteristics.

Without the ability to read the minds of thousands simultaneously, pinpointing the exact cause is elusive. Nevertheless, the timing suggests that it was, in part, a reaction to the discouraging job numbers from the previous week. As I noted yesterday, those figures pertained to the past week, while the much more encouraging monthly jobs report released today covers a period ending midway through the prior month.

Since the conclusion of that period covered by today’s data, the Fed’s Beige Book has revealed that many regional Fed Chairs are observing economic weakness that seems potentially more enduring than initially assumed. Interestingly, in today’s topsy-turvy environment, this grim assessment from the Fed was perceived by traders, when it emerged on Wednesday, as increasing the likelihood of additional monetary and fiscal stimulus. Consequently, it propelled stocks to yet another record high.

However, yesterday’s market reaction seems to suggest that perhaps the Fed’s concerns are justified and that, regardless of policy actions, the economy is still struggling. Traders may be coming to terms with the possibility that there won’t be a swift economic rebound to match the stock market’s performance.

This is indeed disconcerting, but some reassurance can be derived from the nature of the selloff.

It primarily targeted major tech companies. While this is unfavorable for those with significant exposure to big tech stocks (myself included), in the broader context, it’s a positive sign. This sector has consistently delivered strong gains for quite some time, so the selling appears more like a necessary correction than a major cause for alarm.

However, the true litmus test for whether yesterday’s events were a brief, necessary correction or the prelude to a prolonged period of volatility lies in today’s market response. The pattern established yesterday persists, with the Nasdaq down after the job report, while the Dow remains up. If this holds, it suggests that yesterday’s downturn was more of a technical correction than a warning signal. Conversely, if traditional sectors like industrial and manufacturing reverse their course during the day, it would raise concerns for the broader market.

In summary, the current outlook suggests that yesterday’s substantial stock decline resembled a short-lived, much-needed retracement rather than the onset of a significant correction. However, any substantial selling throughout the day could alter this perspective, especially with a holiday weekend approaching, introducing a potential risk. Therefore, I’ll maintain a hedged position and guard against larger market moves.

For me, this entails a modest short position in S&P 500 futures. While this approach may not be suitable for everyone, it’s worth considering a small position in an asset that would benefit if the decline continues, such as an inverse index or VIX ETF. This not only allows for profits during the downturn but also reinforces discipline in adhering to your long-term investment strategy. Panicked wholesale selling is less likely when you can remind yourself that you foresaw a drop and are generating a profit from it.

In conclusion, the verdict on whether yesterday’s drop was an outlier or a harbinger of more significant turbulence remains uncertain. For now, managing a small loss to safeguard against further declines appears prudent.

Get back to Seikum News 🤓