Some consider investing in wine as a way to drown their stock market sorrows.

Some consider investing in wine as a way to drown their stock market sorrows.

Investors seeking refuge from the current turmoil in the stock market might find solace in the fine wine market – provided they’re willing to adopt a long-term perspective, as suggested by the creators of a novel analytical tool dedicated to collectible wines.

According to the architects of AuctionForecast.com (registration required), the potential in wine arises from China’s economic woes, which have significantly contributed to the recent global stock market decline.

Sisi Liang, a risk consultant with BCG Platinion and co-creator of AuctionForecast.com, states that, “Due to the Chinese stock market crash’s impact on fine wine prices, the near future could be a fantastic opportunity for interested investors to enter the fine wine market and reap substantial rewards over the long term.”

However, long-term participants in the wine investment arena remain skeptical, asserting that purchasing at present is primarily suitable for speculators who possess a pronounced appetite for risk.

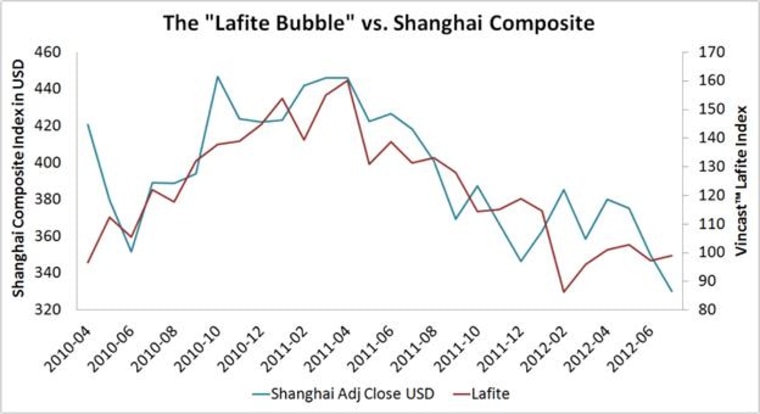

Karl Storchmann, economics professor at New York University and managing editor of the Journal of Wine Economics, argues that wine has generally not proven to be a lucrative investment, apart from the period between 2007 and 2010, which he views as a bubble.

Liang and physicist Joseph L. Breeden, creators of AuctionForecast.com, challenge this skepticism by proposing that investors who are prepared to wait for years can leverage the tool’s “Vincast Index.” This index incorporates data from over a million global wine auctions, evaluates the life cycle and quality of each vintage, and factors in external variables like market conditions, providing an advantage in the market.

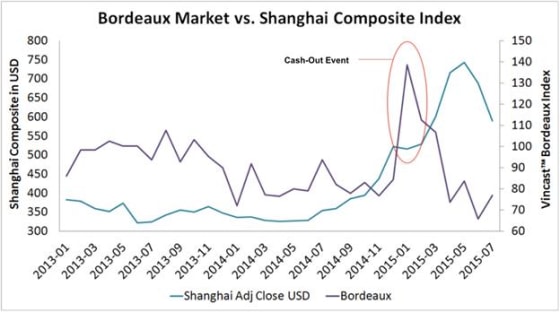

Liang singles out high-end collectible French wines such as Bordeaux and Burgundy, which she claims have delivered average returns of over 50 percent over a decade, provided they were not purchased at peak prices. She argues that Chinese investors have wielded significant influence over the prices of investment-grade wines for years but appear to have mostly exited the market recently due to turbulence in China’s stock market.

Tommy Keeling, a market analyst at the British agency International Wine and Spirit Research, acknowledges that while wine consumption in China has grown substantially, demand for high-end wines started to wane in 2013. He attributes this shift primarily to a Chinese government anti-corruption campaign that curtailed extravagant spending by wealthy Chinese individuals.

Nonetheless, Liang contends that the correlation between the Shanghai Composite Index and wine prices has been evident. She believes that the rapid rise and fall of the wine market preceded the stock market, as sophisticated Chinese investors transferred their funds from stocks to the wine market before the stock market crash.

While Liang and Breeden cannot predict when the Chinese market will hit its lowest point, they suggest that a buy-and-hold strategy will yield historical returns of around 50 percent over a decade, irrespective of market recovery. They also believe that returns could be even higher if the Chinese economy strengthens in the coming years.

However, other wine experts urge caution for those considering entry into this intricate market. Storchmann emphasizes that most wines are not suitable for investment due to the associated storage and other costs over time. He also underscores that while stocks provide dividends, wine only offers capital appreciation.

Many experts in the industry echo this cautious approach, and some contend that wine prices are still relatively high for certain wines beyond Bordeaux.

In the current climate, Thomas Matthews, executive editor for Wine Spectator, suggests that savvy buyers may find undervalued wines in upcoming Hong Kong auctions. The prices of wines at auction often follow broader stock market trends. Auction houses in Hong Kong have scheduled sales for September, and Matthews believes the recent stock declines, both in China and globally, could dampen enthusiasm among key buyers and lower prices. Nevertheless, he expects any slump to be limited to a select few fine vintages.

All the experts concur that even if fine wine investments do not deliver stellar returns, another form of appreciation remains possible: savoring the delightful liquid asset.

Get back to Seikum News 🤓