Greater Secondary Market Liquidity is Required for Small Businesses

Greater Secondary Market Liquidity is Required for Small Businesses

Good morning, and thank you for being here today. I extend a warm welcome to the esteemed members of the Advisory Committee on Small and Emerging Companies. Your dedication and contributions to our discussions are highly valued. I’d like to express my gratitude to the Division of Corporation Finance’s Office of Small Business Policy for their diligent organization of this meeting.

Today, I am pleased to see that our agenda includes a crucial topic: the secondary trading environment for small business securities. The absence of a fair, liquid, and transparent secondary market for these securities is a persistent issue that requires a decisive solution. I have previously addressed this matter in various public forums, most recently at the annual SEC Speaks conference less than two weeks ago. The urgency of this matter has grown as the Securities and Exchange Commission (SEC) is set to implement or propose new rules as mandated by the JOBS Act. These rules will broaden the scope of small business securities that need access to secondary market liquidity. Specifically, proposed rules under Regulation A+ and Crowdfunding, as well as final rules under Rule 506(c) of Regulation D, will facilitate wider distribution and immediate trading of such securities, often with reduced ongoing reporting requirements compared to listed securities.

Furthermore, proposed changes to Section 12(g) of the Securities Exchange Act of 1934, under the JOBS Act, will substantially increase the number of record holders a company can have before it must publish annual and quarterly reports. The Crowdfunding proposal also excludes certain purchasers of shares from being counted as record holders under Section 12(g), effectively preventing the triggering of these provisions regardless of the number of shareholders. Consequently, companies will be able to sell securities to a broader range of the public and remain outside the regulatory safeguards of the Exchange Act for longer periods, potentially indefinitely. This scenario presents a concern for investors, especially those less financially experienced, who may be left with shares they cannot readily sell.

The Concept of “Venture Exchanges”

One proposed solution to foster an active secondary market for small business stocks is the establishment of one or more venture exchanges sanctioned by the SEC. These exchanges would cater to smaller-cap companies with less stringent listing requirements. While this idea is not entirely novel, previous efforts to establish such exchanges in the United States have encountered difficulties. Therefore, we must approach this matter thoughtfully and examine why past initiatives have faltered. As the saying goes, “Those who cannot remember the past are condemned to repeat it.”To better understand the challenges, we should investigate the reasons behind the American Stock Exchange’s Emerging Company Marketplace (ECM) failure. Although the ECM initially thrived due to lower transaction costs, it ultimately succumbed to several design flaws. Profitable firms graduated to the American Stock Exchange, creating the perception that the ECM was populated only by unsuccessful companies. The ECM also failed to screen candidate firms properly, leading to scandals and tarnishing its reputation. Some have suggested that narrow bid/ask spreads on the ECM may have discouraged broker-dealers from making markets for these stocks, reducing liquidity and research coverage.

The demise of the ECM offers valuable lessons, but it is not the sole source of guidance. Several European stock markets have experimented with junior exchanges for smaller companies, with limited success. Furthermore, the 2011 attempt to establish a new venture exchange in the United States, the Nasdaq BX Venture Market, has stalled. We should also consider the recent challenges faced by Canada’s TSX Venture Exchange, which has been affected by an over-reliance on mining and energy firms amid global commodity price declines.

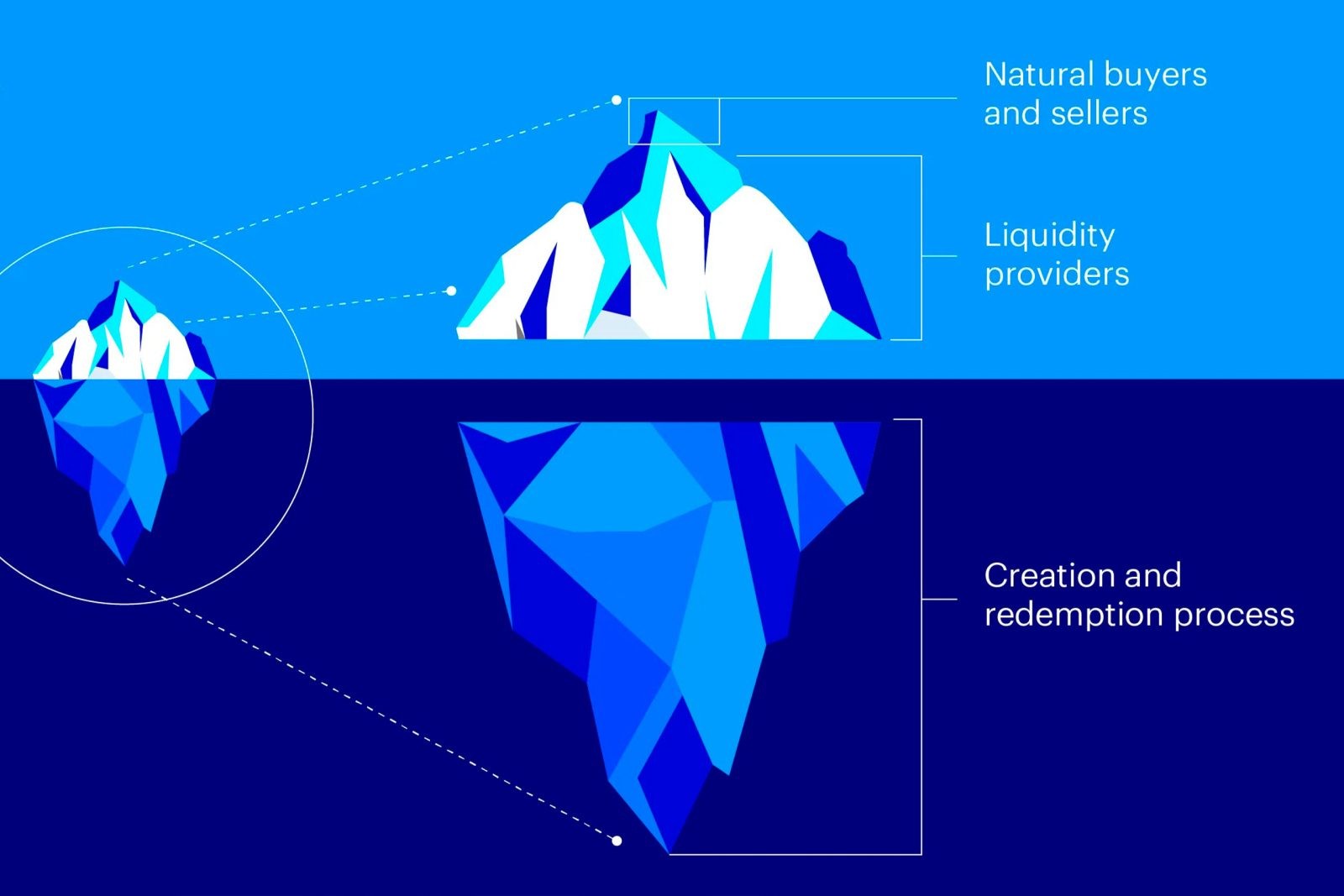

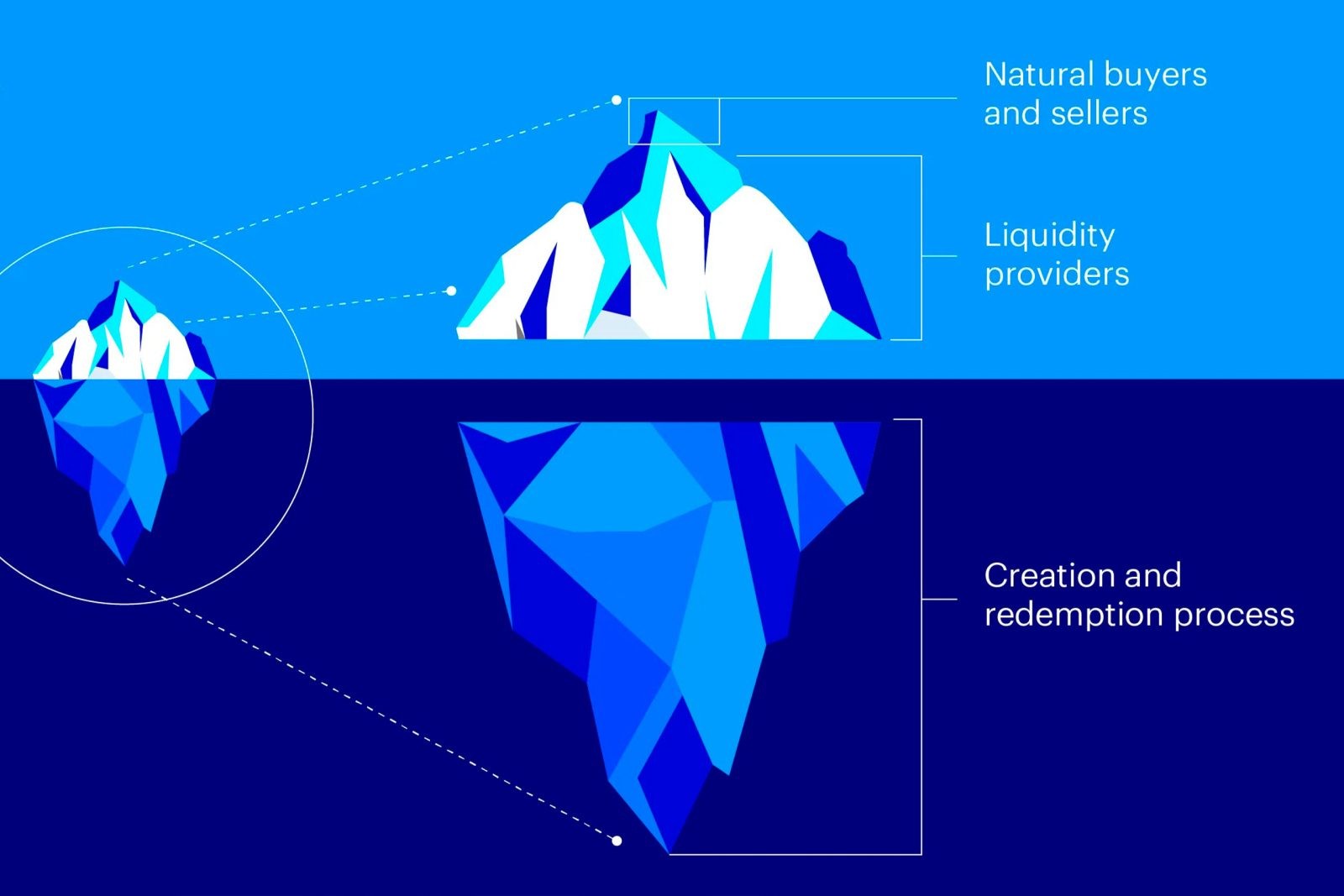

Reports suggest that venture exchanges, both domestically and abroad, have struggled with low liquidity and, at times, high volatility. This exposes investors to rapid financial losses and difficulty selling shares during market downturns. The SEC must examine the root causes of these issues and determine the best strategies to address them. To this end, we should consider various questions, such as whether venture exchanges should function as dealer markets rather than auction markets and whether batch auctions could enhance liquidity instead of continuous trading. We must also explore ways to encourage traders to execute transactions on venture exchanges rather than off-exchange venues. Additionally, increasing ticker sizes may boost liquidity by promoting market maker activity and research coverage, with the SEC’s proposed tick size pilot program offering valuable insights into the role of tick sizes in supporting active secondary markets for smaller companies.

Importantly, addressing these questions may involve trade-offs between investor interests and the interests of exchanges and participating broker-dealers. We must consider these trade-offs carefully as we evaluate proposals for new venture exchanges and remain steadfast in our commitment to safeguarding investor interests.

Educating Investors and Promoting

Accountability Investors must understand what venture exchanges represent and what they do not. Some may mistakenly view venture exchanges as platforms for discovering the next Apple, Google, or Facebook. However, it is not that straightforward. In fact, studies have shown that London’s venture exchange, the Alternative Investment Market, has had fewer high-performing firms than traditional exchanges. Venture exchanges often feature a higher proportion of small, early-stage companies operating in high-risk sectors. Consequently, companies listed on venture exchanges may significantly underperform and present higher risks than those on traditional exchanges.While venture exchanges can attract reputable and profitable companies, we must acknowledge that they may harbor more risks than investors anticipate. Therefore, we must thoroughly understand and address these risks before approving additional venture exchanges. Additionally, it is crucial to ensure that investors are well-informed about these risks.

Studies have indicated that venture exchanges are more likely to succeed when they prioritize investor protection and education. Implementing appropriate listing standards, consistently enforcing them, and educating investors about the heightened risks associated with small-cap companies have yielded better outcomes. Therefore, we should proceed with caution, taking into account the potential benefits, costs, and challenges, always with investors’ needs at the forefront.

Reforming the Broker-Dealer

“Piggy-Back” Rule Another measure to consider for facilitating secondary trading of small business securities is revising and updating Exchange Act Rule 15c2-11, particularly its “piggy-back” exception. Broker-dealers widely use Rule 15c2-11 to trade unlisted securities. In 2014, over 10,000 of these unlisted securities traded in the over-the-counter (OTC) markets, representing a total dollar volume exceeding $240 billion.To utilize Rule 15c2-11, broker-dealers wishing to publish quotes for unlisted securities, which often involve smaller issuers, must review and maintain specific information about the security and issuer. Moreover, broker-dealers must reasonably believe that this information is materially accurate and obtained from reliable sources before publishing quotes. Trust is a central element in this context as investors must have confidence in the fairness and accuracy of security quotes. Without this confidence, a fair and liquid secondary market for these securities becomes untenable.

Regrettably, the existing use of Rule 15c2-11 often fails to meet expectations for fair and accurate pricing and frequently results in unreliable quotes. Of particular concern is the “piggy-back” exception, which allows broker-dealers to publish quotations without adhering to the rule’s information requirements if another broker-dealer has previously published quotes for the same security. This means broker-dealers can piggy-back on their own or other broker-dealers’ prior quotations without reevaluating the issuer or security’s information, regardless of how dated the original review may be. This approach is inefficient for creating a fair and efficient market and does little to instill trust in such a market.

The shortcomings of Rule 15c2-11 have long been recognized, and proposals to amend the rule have been proposed. Notably, these proposals aimed to address fraud and manipulation concerns in microcap securities traded in the OTC market. However, these proposed amendments were never finalized.

Many of the concerns raised in these prior proposals are equally relevant today, especially in the context of secondary trading for small business shares. These proposed rules, which may be beneficial in today’s market, include:

- Eliminating or amending the “piggy-back” exception, requiring broker-dealers to conduct reviews of issuer and security information before publishing quotes.

- Mandating broker-dealers that publish quotes to obtain and review current issuer information annually, ensuring accountability and encouraging a diligent review process.

- Enhancing investor access to information collected and maintained by broker-dealers about issuers, making such information readily accessible over the internet.

In Conclusion

In closing, I wish to mention that today’s discussions also cover recommendations regarding the definition of “accredited investors.” My views on this topic remain consistent with what I shared with this Committee in December 2014.Another topic under consideration today is the formalization of the “Rule 4(a)(1½)” exemption, which shareholders often rely upon to sell restricted securities in private transactions. While formalizing this rule is a welcome step, it does not address the fundamental challenge of whether sellers will find willing buyers or access a secondary trading market that is fair, transparent, and liquid. To achieve the latter, we need more than just clarifying the boundaries of Rule 4(a)(1½).

Ultimately, our goal is to develop a viable secondary trading environment that fosters a fair, transparent, and liquid market for small business securities. Such a market will provide investors with the confidence that they are being treated equitably while promoting the growth of small businesses. Protecting investor interests remains our foremost responsibility.

I eagerly anticipate robust discussions today, exploring all viable suggestions for improving the secondary trading environment for small business securities. Thank you.

Get back to Seikum News 🤓