What will the price of Amazon be in 2020? Will the e-commerce behemoth rule the markets?

What will the price of Amazon be in 2020? Will the e-commerce behemoth rule the markets?

In 2019, it was nearly impossible to find someone unfamiliar with Amazon, a prominent member of the influential FAANG group of technology giants. The global spotlight was on Amazon, attracting the attention of countless investors worldwide. Amazon (AMZN) remains a favorite among investors due to its ubiquitous presence. The e-commerce giant spans various sectors, offering products and services that touch nearly every aspect of consumers’ lives, from clothing and cosmetics to media devices, food, web services, and beyond. However, 2019 proved to be a challenging year for Amazon. Concerns about antitrust investigations, political criticisms, disappointing quarterly reports, the closure of its Chinese business segment, and volatile stock markets cast shadows over the company. With the year coming to a close, the big question is: What does the Amazon share price forecast hold for 2020 and beyond? Should investors buy or sell Amazon stock?

US Retail Industry Overview

To gauge Amazon’s future, it’s crucial to examine the industry landscape in which the company operates. 2018 presented a complex scenario for the retail sector. While the US experienced robust economic growth and a record-breaking holiday season, it also witnessed mixed retail earnings and notable bankruptcies. This occurred amid global trade tensions and political uncertainty. Nevertheless, 2018 saw retail sales reach a record high of $6 trillion. Though 2019 is not yet over, it has already raised many questions. Retailers are realizing that bold strategies may be necessary to thrive amid economic turbulence and evolving trends. The industry is undergoing a transformative shift from a brick-and-mortar past to a digital future, and consumer spending patterns are also changing. Despite a strong job market and rising disposable income, consumer confidence remains fragile due to economic uncertainties related to US-China trade disputes and Federal Reserve policies. Notably, US retail sales experienced their first decline in seven months in September, raising concerns of a potential spending slowdown.Amazon’s Resilience

Despite industry challenges, Amazon has displayed remarkable adaptability. Few companies boast such a diverse range of opportunities. By revolutionizing the retail experience and dominating the digital space, Amazon has secured its position as the leading online marketplace in the US, attracting over 206 million visitors each month. In 2017, Amazon acquired Whole Foods Market for $13.4 billion, expanding into the grocery and food delivery sector. The company has also ventured into healthcare, purchasing online pharmacy firm PillPack for nearly $1 billion. Amazon continues to invest heavily in transportation, cloud computing, artificial intelligence, video content, and online video services, competing with tech giants like Microsoft and Netflix. Among its successes is Amazon Web Services (AWS), a market leader in cloud-based computing services. In Q3 2019, AWS contributed 71 percent of Amazon’s total operating income and 13 percent of its total revenue. In September 2018, Amazon became the second company, following Apple Inc., to reach a market capitalization of $1 trillion.Amazon’s Stock Price Analysis

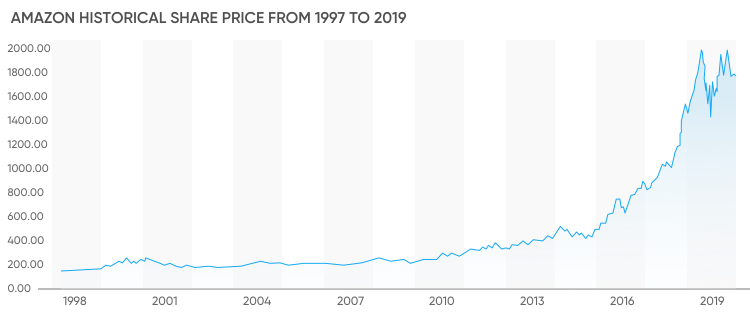

Amazon’s stock has experienced a remarkable journey since its IPO in 1997. Initially priced at just $18 per share, the company defied the dot-com crash and witnessed substantial growth. The stock reached an all-time high of $2,050.50 on September 4, 2018, representing over 11,200 percent growth from its IPO. However, it also faced challenges, with a low of $1,340 per share in December 2018. Since then, the stock has displayed volatility, influenced by various factors, including quarterly earnings reports. In the third fiscal quarter of 2019, Amazon reported lower net income compared to early 2018, with revenue increasing by nearly 24 percent to $70 billion, while profits fell by almost 26 percent to $2.1 billion. Looking ahead, Amazon expects Q4 revenue to range from $80 billion to $86.5 billion, reflecting growth between 11 percent and 20 percent.

Amazon Stock Forecast

While concerns such as antitrust allegations and industry performance may affect Amazon’s image and value, many experts believe the company will continue expanding. They anticipate hearing more about Amazon’s successes in growth areas like advertising, cloud computing, and artificial intelligence.

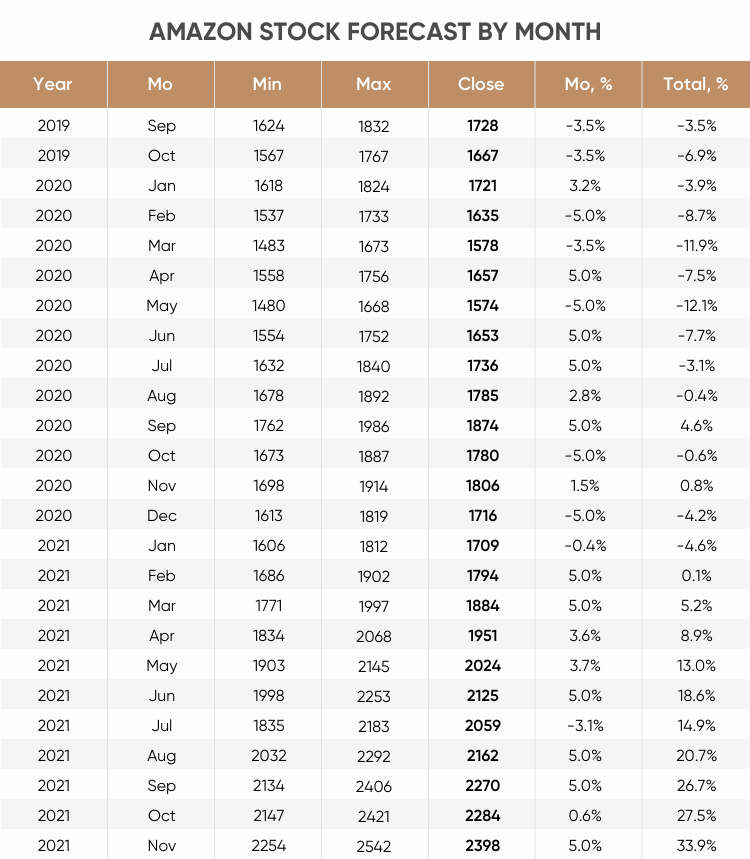

Several forecasts indicate a positive outlook for Amazon’s stock. Longforecast.com predicts Amazon shares could reach $2,398 by November 2021. Wallet Investor sees Amazon trading at $3,841 by November 2024, offering substantial long-term returns. CNN Business surveyed 44 analysts, with a median target of $2,200 for Amazon’s stock, ranging from $1,900 to $2,573. Gov Capital offers an exceptionally optimistic outlook, projecting a price of $10,720 by mid-November 2024. As investors eagerly await Amazon’s next financial report, it remains to be seen if the company can meet these high expectations in 2020 and beyond.

Get back to Seikum News 🤓