August 2020 monthly markets review

August 2020 monthly markets review

United States

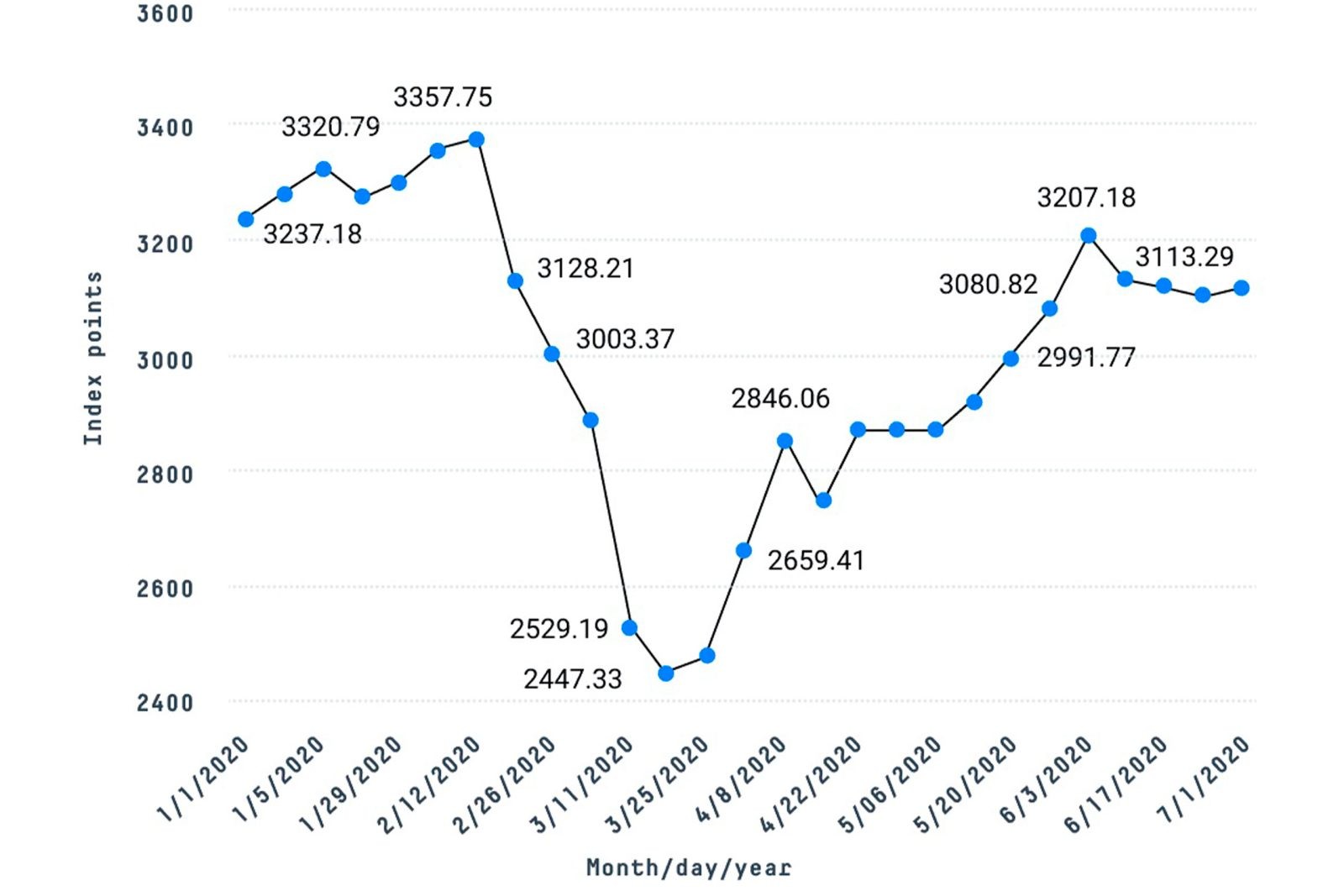

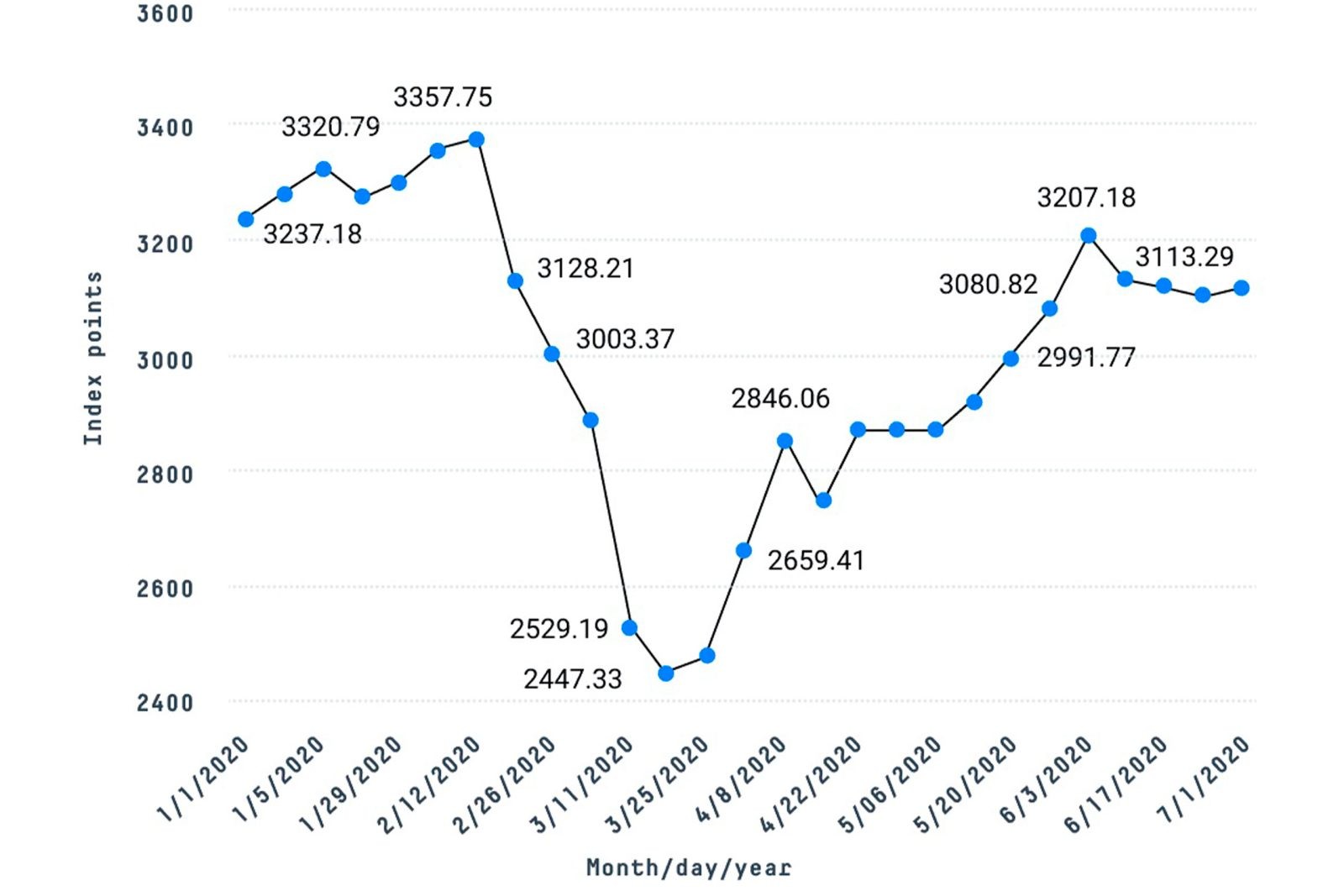

In August, U.S. equities, represented by the S&P 500, reached new record highs despite escalating tensions between the United States and China. What initially began as a trade dispute between the two nations has evolved into restrictions on diplomats and military posturing. However, these ongoing tensions were somewhat overshadowed by economic data during the month, which, while mixed, indicates that the economic recovery is still in progress. The Federal Reserve (Fed) reiterated its readiness to provide further support while adjusting its measurement of inflation to increase flexibility. Although the Fed expects inflation to remain subdued, it is adopting an “average inflation targeting” approach, allowing for temporary tolerance of inflation exceeding the 2% target. Year-on-year inflation (core CPI) rose from a low of 1.2% to 1.6% in July, driven by rising gasoline prices, which increased by 5% in July, as well as higher prices for apparel, used cars, and airfares. Meanwhile, the number of Americans applying for unemployment benefits dropped below one million for the first time since the pandemic began in March. However, retail sales in July saw lower-than-expected growth, and consumer confidence remained muted. The Information Technology (IT) sector continued to make notable contributions to the market’s gains in August. Sectors tied to an improving economic cycle, such as industrials and consumer discretionary, also saw increases. Utilities and real estate were weaker sectors, as were energy stocks.Eurozone

Eurozone equities posted gains in August, although they lagged behind other regions. Sectors tied to economic sensitivity, like industrials and consumer discretionary, were the top performers. The healthcare sector, which had performed well earlier in the year, lagged as investors favored areas expected to benefit more from an economic recovery. Automakers received a boost from data indicating rising car sales in China. Overall, the Q2 earnings season exceeded expectations. The euro continued to strengthen against the U.S. dollar. Data confirmed that the eurozone economy contracted by 10.1% in Q2, with Germany’s economic decline revised to 9.7% from the previous estimate of 10.1%. Concerns persisted about increasing Covid-19 infections in some countries, particularly Spain and France, leading to various travel restrictions. Germany extended its worker pay top-up scheme, initially set to expire in March 2021, until the end of the next year. The pace of recovery slowed according to the latest Purchasing Managers’ Indices (PMIs). The composite index for August reached 51.6, down from 54.9 in July. (A reading of 50 separates expansion from contraction.) PMI surveys are based on responses from companies in the manufacturing and services sectors.United Kingdom

UK equities rose in August as global growth prospects improved, leading to a recovery in risk appetite. Signs of a potential solid recovery in the UK economy in Q3 2020 also supported small and mid-cap (SMID) equities. The market partially rebounded from July when concerns about a second wave of Covid-19 infections dominated sentiment. Economically sensitive sectors, including those hit hardest during the pandemic, led the market higher. Corporate news in many of these sectors improved, reflecting more positive macroeconomic data seen over the summer. These trends contributed to the outperformance of domestically-focused equities and UK SMIDs, while the strength of the pound against a weak dollar weighed on internationally-exposed large caps. The UK economy showed signs of a summer rebound, aided by fiscal policy support and a milder resurgence in Covid-19 cases compared to other areas. However, the potential for increased job losses remains uncertain. While the Office for National Statistics confirmed that the UK economy entered a recession in Q2, the market focused on news of an 8.7% monthly GDP increase in June 2020, supporting hopes for a reasonably sharp Q3 recovery.Japan

The Japanese equity market rebounded quickly in August, recovering ground lost at the end of July and trading sideways for the rest of the month to end 8.2% higher. Speculation about the potential resignation of Prime Minister Abe emerged during the month and led to a minor dip in share prices. His resignation was confirmed later in the month, causing a small net weakening of the yen against most major currencies. Shinzo Abe’s resignation, due to health issues, followed him becoming the longest-serving Japanese prime minister just four days earlier. His popularity had waned recently, primarily due to his handling of Japan’s response to the pandemic. New infections, albeit from a low base, led to criticism of policy inconsistencies. The LDP chose the simplest method to elect their next party president, with this election expected to take place on September 14. Yoshihide Suga, currently Chief Cabinet Secretary, emerged as the front-runner in early September. While corporate profits were under pressure, the recent quarterly earnings season brought more positive surprises than expected. The pandemic made it difficult to form a clear consensus for earnings, as many companies refrained from providing guidance due to extreme uncertainty. Approximately 40% of companies beat market expectations, 40% met expectations, and 20% underperformed, compared to a more typical split of one-third each.Asia (excluding Japan)

The MSCI Asia ex Japan index posted strong returns in August, driven by hopes for a Covid-19 vaccine, ongoing economic recovery, and U.S. dollar weakness. The index was led higher by China and Hong Kong SAR, where Covid-19 infection rates declined, and most sectors performed well. Strong Q2 earnings results in China boosted sentiment, although tensions with the U.S. escalated. China and India experienced border skirmishes towards the end of the month, causing India to give back some of its earlier gains. However, India still performed broadly in line with the index, despite a rise in daily Covid-19 cases. In contrast, Malaysia, Thailand, and Taiwan ended the month with negative returns and were the weakest performers in the index. Taiwanese equities were impacted by weakness in IT stocks, especially those in Apple’s supply chain, due to U.S.-China tensions.Emerging Markets

Emerging market (EM) equities recorded positive returns in August due to increasing hopes for a Covid-19 vaccine and the Fed’s new monetary policy strategy, which indicated that interest rates could remain low for an extended period. However, EM equities underperformed the MSCI World Index. Egypt led as the best-performing market in the MSCI Emerging Markets Index, while China also outperformed thanks to stronger-than-expected Q2 earnings, especially in the e-commerce sector. The U.S.-China tensions escalated, including sanctions on technology giant Huawei, but China maintained its commitment to Phase I of the US-China trade deal. Increased prices for materials and energy supported net exporter EM countries like Peru, the UAE, Saudi Arabia, and Qatar, all of which outperformed the index. Diplomatic recognition between the UAE and Israel also boosted sentiment in Middle Eastern markets. India performed ahead of the index, despite an increase in daily Covid-19 cases and renewed tensions with China at the end of the month. Conversely, Chile and Brazil ended with negative returns and were the weakest index markets, exacerbated by currency depreciation. Turkey and to a lesser extent Taiwan also underperformed, with currency weakness contributing to negative returns.Global Bonds

Investor sentiment and risk appetite remained strong in August. Government bond yields rose while the U.S. dollar continued to weaken. Corporate and emerging market bonds performed well. Investors paid little attention to concerns about Covid-19 and focused on the Federal Reserve’s annual conference at Jackson Hole late in the month. The Fed announced it would tolerate higher inflation, abandoning its 2% target in favor of a 2% average level. This strengthened expectations of highly accommodative monetary policy for an extended period. The global economy continued to show signs of modest recovery. The U.S. 10-year Treasury yield increased by 18 basis points to 0.70% in August, while in Europe, Germany’s 10-year yield was 13 basis points higher at -0.40%, and France’s rose by 10 basis points to -0.10%. Italy and Spain outperformed, with their 10-year yields rising by eight and seven basis points, respectively. The UK 10-year yield increased by 21 basis points to 0.31%. Corporate bonds outperformed government bonds, with high-yield credit leading the way due to strong risk appetite. Investment-grade corporate bonds experienced negative total returns due to rising yields. Emerging market government and corporate bonds in hard currency produced positive returns, led by high-yield bonds. Local currency-denominated EM debt experienced slight losses, with mixed performances from EM currencies. The Mexican peso, Chinese yuan, and Indian rupee strengthened against the dollar, while the Brazilian real and Turkish lira weakened. The Thomson Reuters Global Focus index, measuring convertibles, increased by 2.6% compared to a 6% gain in the MSCI World equity index. Global investors showed interest in convertibles, leading to more expensive valuations, especially in the U.S. segment of the market, which has a high concentration of technology-related companies.Commodities

The S&P GSCI (commodities index) recorded positive returns in August. Agriculture was the best-performing component, with corn and soybeans achieving robust gains. Energy and industrial materials components also saw strong increases, driven by rising demand as global economic activity continued to recover. Industrial metals, particularly nickel and zinc, gained amid increased demand from China. In precious metals, silver continued to perform well, while gold experienced a slight decline.

Get back to Seikum News 🤓