2018’s top gainers and losers in terms of shares

2018’s top gainers and losers in terms of shares

The year 2018 has been a standout period characterized by notable stock market volatility. Throughout the year, there were instances when the market witnessed declines exceeding 3%.

A Year of Unprecedented Stock Market Volatility

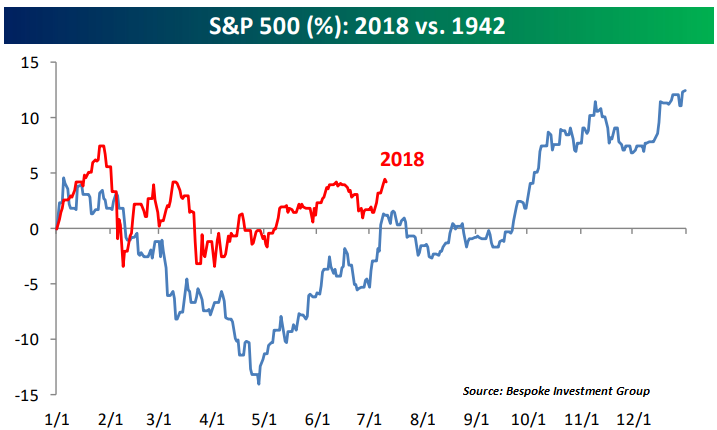

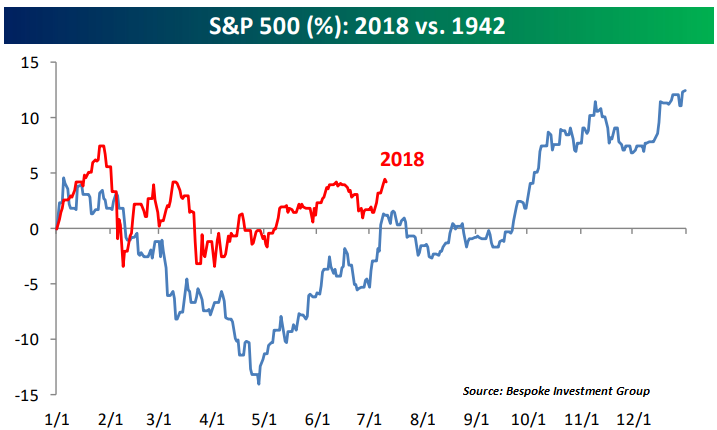

The year 2018 kicked off rather sluggishly, with stock markets stumbling at the onset of February. The ensuing months saw a rollercoaster ride as volatility surged, with market stability oscillating between phases of tranquility and turbulence. Investors found themselves on a whirlwind journey as concerns alternated between a sluggish economy and one that appeared to be overheating. Bespoke Investment Group’s analysis indicates that the closest historical parallel to the market’s performance in 2018 is the year 1942.

Stock Market’s Top Movers: Notable Gainers and Losers

As we approach the year’s end, let’s delve into a closer examination of the most significant stock market gainers and losers in 2018. To narrow our focus, we’ve considered the top 200 of the most actively traded instruments throughout the year. You may find some of the top performers surprising.Top Stock Market Winners in 2018

Without further ado, let’s unveil the companies that emerged as the biggest stock gainers by November 27, 2018:- Advanced Micro Devices Inc: Starting Price: $10.39, Ending Price: $21.03, Change: +102.41%

- Under Armour Cl A: Starting Price: $14.53, Ending Price: $21.75, Change: +49.69%

- Dominos Pizza: Starting Price: $186.96, Ending Price: $268.32, Change: +43.52%

- Wirecard AG: Starting Price: $93.21, Ending Price: $130.83, Change: +40.36%

- Petroleo Brasileiro SA: Starting Price: $10.43, Ending Price: $14.33, Change: +37.39%

Advanced Micro Devices (AMD): Up 102.41%

AMD, the world’s second-largest microprocessor manufacturer, emerged as the best-performing chip producer in the S&P 500 index for 2018. The company’s sales surged by 53% in the second quarter of 2018 compared to the same period in 2017, driven by the success of its computing, graphics, and enterprise hardware.Netflix: Up 36.1%

The streaming-TV titan Netflix witnessed bullish investor sentiment throughout the year, underpinned by robust financial performance and user growth. The company achieved a significant revenue increase of 43.2% and added 7.41 million subscribers.Twitter: Up 35.83%

Twitter, boasting 325 million active monthly users by late 2018, exhibited strength in stock market performance. The company’s shares climbed by 35.83%, primarily attributable to a transition from a net loss of $62 million in 2017 to a net profit of $61 million in Q1 2018. Twitter continued to record year-on-year double-digit growth in active daily users.Amazon: Up 34.65%

Amazon, the e-commerce juggernaut, continued to dazzle investors in 2018 with stellar performance. The company reported a staggering $2.5 billion profit in Q2 2018, a remarkable 1,200% increase from the same quarter in 2017. Amazon’s cloud computing business, Amazon Web Services (AWS), played a pivotal role in these results.Microsoft: Up 24.48%

Microsoft’s transition to a cloud-based business model paid off handsomely in 2018, with a revenue increase of $3.1 billion (12%) during Q2 2018. The company’s commercial cloud revenue, including Office 365, Azure, and Dynamics 365 products, experienced robust growth.Top Stock Market Losers in 2018

In the realm of financial markets, where there are gainers, there are inevitably losers. Just as we spotlighted the top gainers, let’s now examine the most significant stock market decliners traded in 2018. Here are the notable losers:- Aryzta AG: Starting Price: $37.32, Ending Price: $1.4, Change: -96.25%

- Capita PLC: Starting Price: $3.995, Ending Price: $1.075, Change: -73.09%

- General Electric Co: Starting Price: $17.55, Ending Price: $7.43, Change: -57.66%

- Snap: Starting Price: $14.62, Ending Price: $6.38, Change: -56.36%

- Alcoa: Starting Price: $53.67, Ending Price: $31.15, Change: -41.96%

General Electric (GE):

Down 57.66% General Electric had a challenging year in 2018, with its shares plummeting by 57%. This loss surpassed even the previous year’s decline. The stock lost more than half its value since January 2018, leading to the company’s removal from the Dow, which likely contributed to the decline.Snap:

Down 56.36% Snap, the technology company behind Snapchat and other popular platforms, witnessed a 56% decline in its share value in 2018. Fierce competition, notably from Instagram, and a significant drop in daily active users were key factors driving this downturn.eBay:

Down 24.39% Global e-commerce giant eBay experienced a decline of over 20% in 2018. Analysts lowered growth estimates for eBay in 2019, further dampening investor sentiment.Facebook:

Down 23.94% Facebook had a tumultuous year, with its stock plummeting since July 2018. Concerns surrounding data privacy, exemplified by the Cambridge Analytica scandal, significantly impacted Facebook’s stock price, causing a decline of over 24% in March 2018.NVIDIA:

Down 21.37% NVIDIA, a global leader in visual and graphics processing units, faced challenges in 2018. Factors contributing to a slight decline of more than 20% included the bursting of the cryptocurrency market bubble, leading to slowed Pascal GPU sales, and announcements by major NVIDIA clients, such as Tesla, that they would develop their own chips.In Conclusion:

While Christmas trees may have already been adorned in various parts of the world, there’s still a month left before the year draws to a close. Stock markets have ample time to deliver surprises before the year’s end. Perhaps it’s time for you to begin compiling your list of favorites for 2019.Get back to Seikum News 🤓